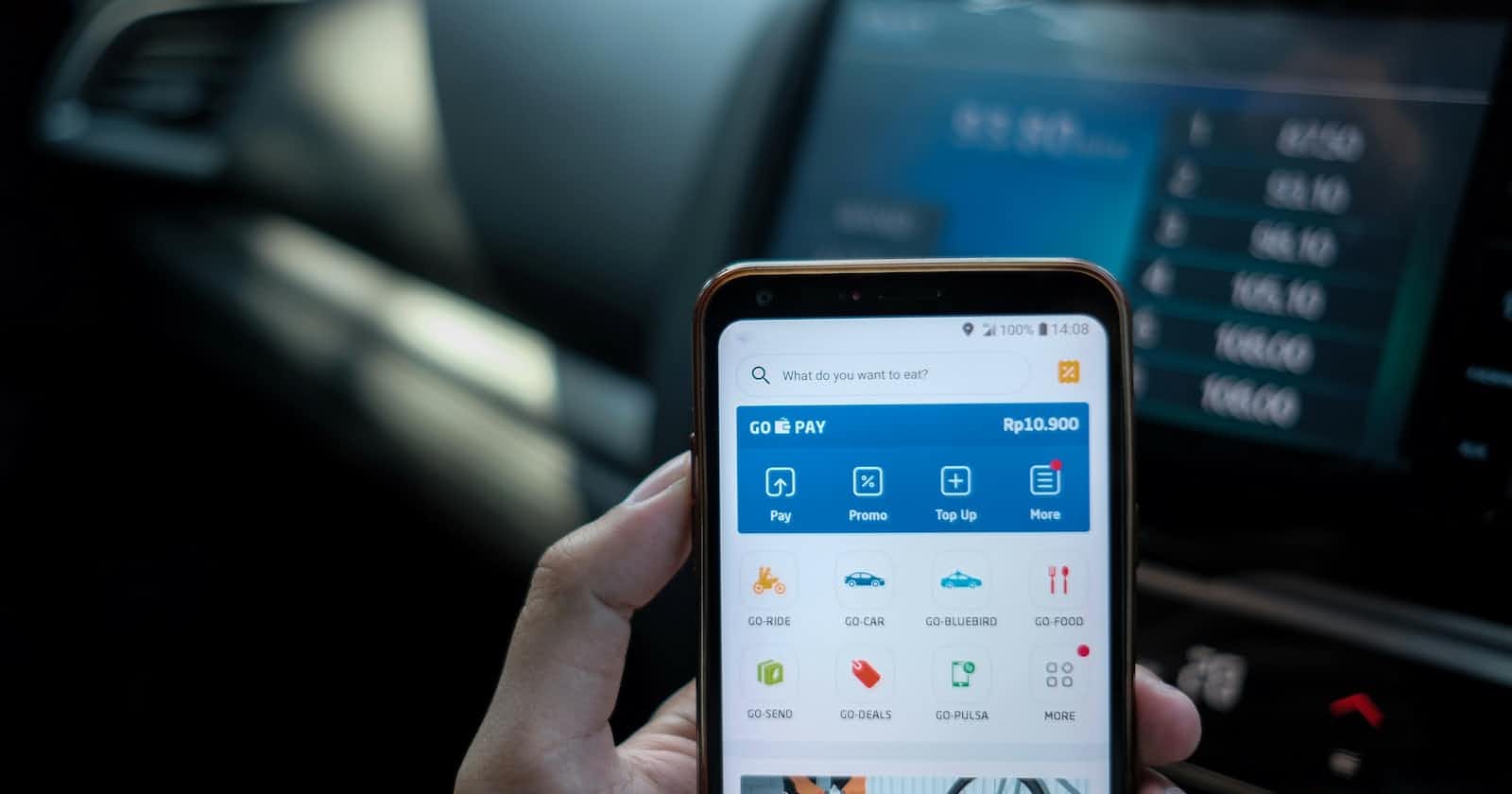

Photo by Edi Kurniawan on Unsplash

Best Practices for Handling Transactions and Security in Financial Systems

Table of contents

Introduction

Modern financial systems require careful consideration of data management, transaction processing, and security. In this tech article, we will discuss crucial aspects of designing a robust financial system, focusing on handling enums, replaying user wallet history, encoding user balance, implementing daily withdrawal limits, and ensuring account security through PIN lockout.

Managing Enums: Enums are an essential concept in many programming languages, providing a convenient way to represent a fixed set of values. However, it's best to avoid handling enums directly at the database level. Instead, create a dedicated class for managing enums. This approach allows for greater flexibility as you might want to modify or extend the enum values in the future. By separating the enum handling from the database, you can ensure backward compatibility while smoothly introducing changes to the enum definition.

Replaying User Wallet History: Before executing any financial transaction, consider replaying the user's wallet history to verify their current balance. This step prevents accidental overspending or inconsistencies in the transaction process. By replaying past wallet activity, you can ensure that the user's balance accurately reflects their transaction history, enabling secure and error-free operations.

Storing Debits as Minus (-): When recording financial transactions, it is common to represent debits as negative values. Storing debits as minus values in the database simplifies calculations and helps maintain a consistent and intuitive accounting system. This practice streamlines queries and ensures accuracy when calculating account balances, improving the overall system efficiency.

Encoding User Balance: To enhance data security, consider encoding the user balance in the database. Encryption techniques like one-way hashing can be applied to protect sensitive information, including user balances. By implementing proper data encryption methods, even if unauthorized access occurs, the user's balance remains concealed and unreadable, safeguarding their financial information.

Implementing Daily Withdrawal Limits: To manage user withdrawals effectively, establish daily withdrawal limits based on individual user profiles. By setting withdrawal limits, you can control the maximum amount users can withdraw within a 24-hour period. If a user attempts to withdraw more than their limit, the system should automatically deduct the excess amount and notify the compliance team for further review.

Storing Configurations in the Database: Storing transaction configurations in the database allows for better control and auditability. These configurations may include the source of funds, destination accounts, and transaction limits. By centralizing this information, you can easily adjust the system's behaviour without requiring code changes, facilitating a more agile and responsive financial platform.

PIN Lockout for Account Security: To enhance account security, implement a PIN lockout mechanism. If a user provides an incorrect PIN a certain number of times (e.g., three times), the system should temporarily lock the account to prevent brute-force attacks. Notifying the user about the account lockout can also enhance security awareness and prompt them to reset their PIN for enhanced protection.

Transaction Logging and Auditing: Maintaining comprehensive transaction logs and implementing auditing mechanisms is crucial for financial systems. Detailed logs help trace the history of transactions, monitor system activity, and identify potential anomalies or fraudulent activities. Auditing also ensures compliance with regulatory requirements and assists in investigations if any issues arise.

Numerical Validation: Ensuring that all numbers involved in transactions are properly validated and formatted is crucial to prevent errors, particularly when handling negative numbers. Mishandling negative values, such as using a double negative (--) when processing user input, can lead to unintended crediting instead of debiting the user's account. Therefore, implementing thorough input validation mechanisms is essential to maintain the integrity of the system and avoid such potential issues.

Conclusion

By adopting these best practices in your financial system's design, you can ensure data accuracy, enhance security measures, and improve the overall user experience. A well-architected financial system instills trust in users and promotes the secure handling of transactions, paving the way for a successful and reliable platform.